Market competition on its own would lead to democratic anarchy NOT TARIFFS INDUCING BUYOUTS.

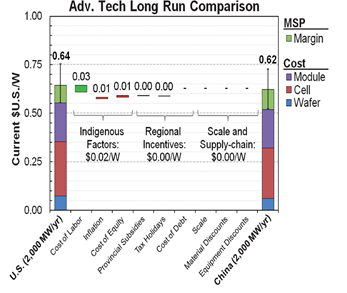

Foreign companies capture the same cost advantage that industrial efficiency and innovation has afforded (Figure W). When I say foreign company and you thought of a company in Shenzhen China or Paris France.

SZ

Market competition on its own would lead to democratic anarchy NOT TARIFFS INDUCING BUYOUTS.

Foreign companies capture the same cost advantage that industrial efficiency and innovation has afforded (Figure W). When I say foreign company and you thought of a company in Shenzhen China or Paris France.

Figure W. 2012 Solar Panel Cost Breakdown

That is fair.

However, a foreign company can afford 1 factory or 10 in the U.S. What good is a tariff on the same foreign companies using their purchasing power can say Made in America. This same foreign company can make a comparable investment, equating the tariff value, and circumvent paying the tax.

More competitive bargaining, less things getting cheaper. Golden Parachutes for few, job insecurity for many. More jobs, less wealth for job holders’ community.

Where do individual Americans profit? That job holder is at the mercy of a company that has no purposeful intention of reinvesting into surrounding community. When they invest, I would bet the PR is on blitzkrieg mode.

Tariffs were precisely used to give US companies a tactic advantage. Which could backfire. In this case,U.S. solar energy manufacturers can’t effectively compete with their global counterparts.

In the vain U.S. PV manufactured goods, Solarworld and Suniva filed a petition with the courts, International Trade Commission, seeking relief from specific solar cell global competitors (crystalline silicon voltaic cell) (United States International Trade Commission, 2017). The petition resulted in Section 201 – Solar Tariffs, placing a 30% tax on all crystalline silicon imports with certain contingencies. The tariffs benefited other types of PV manufacturers systems (both US and abroad) and US silicon PV manufacturers.

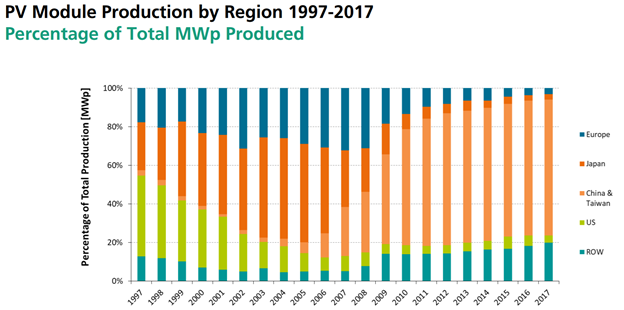

Figure T. Global Manufacturing as Whole

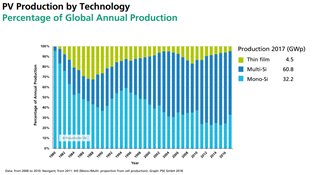

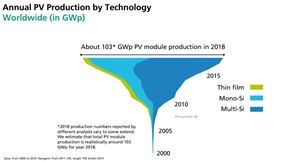

The tariff impacts have been projected in terms of loss of renewable energy investment, loss of employment, and reduction of PV deployment. The tariff can possibly help CdTe and CiGS PV systems gain market share away from the predominant silicon-based systems. Depicted in Figure F, thin film PV modules are 4.5 GWs of the 97.5 GWs produced in 2017. The tariffs reduce the overall function of cost, pressing consumers to consider health, environmental, and life-cycle impacts.

Figure F. PV Production Type

Section 201 Tariff Contingencies

Exceptions have been registered in the solar tariff. The tariff reduces by 5% per year and excludes the first 2.5 GW crystalline silicon cells per year (Solar Energy Industries Association, 2019). These cells are to be used by US manufacturers producing PV modules. Recently, bifacial silicon modules and cells were exempt from the tariff to remain at a competitive price, which was recently reverse (Merchant, 2020; National Renewable Energy Laboratory, 2019).

New PV Manufacturing Factories

Another effect of the tariff has led to an increase in US PV production capacity. Foreign silicon PV manufacturers have built factories within the US. Jinko Solar (400MW), Heliene (130MW), LG Solar (500MW), and Hanwha Q Cells (1.6GW) have begun building factories in the US as a way to circumvent tariffs (Merchant, 2019).

Solarworld, one of the companies in the original petition, was bought out by Sunpower (French parent company Total S.A). The tariffs were costing Sunpower $2 million a week. Shortly after, the company requested an exemption for the investment or planned to close factories.

The solar labor market is largely a part of deployment. The solar industry employs 242,000 people throughout manufacturing, construction, operation and maintenance, and recycling product life cycle in the U.S. (The Solar Foundation, 2018). The industry has seen a continual growth in employment until recently where the industry suffered a decline of 8,000 jobs. Tariffs do nothing for US manufacturing and increase the cost of tariffs for the end purchaser, the US consumer.

Tariffs helped or hurt U.S. solar industry?

References

Fraunhofer. (2019). Photovoltaic Report. Germany: Fraunhofer.

Merchant, E. (2019, Feb 25). The Status of US Solar Manufacturing, One Year After Tariffs. Retrieved from Green Tech Media: https://www.greentechmedia.com/articles/read/us-solar-manufacturing-status-tariffs#gs.t0nno6

National Renewable Energy Laboratory. (2019). Solar Industry Update. Washington, D.C.: United States Government.

Solar Energy Industries Association. (2019, Feb 6). Section 201 Solar Tariff. Retrieved from SEIA: https://www.seia.org/sites/default/files/2019-12/SEIA-Section-201-Factsheet-Dec2019.pdf

The Solar Foundation. (2018). National SOlar Jobs Census. The Solar Foundation.

United States International Trade Commission. (2017, August 14). USITC Hearing, Witness List – Crystalline Silicon Photovoltaic Cells. Retrieved from USITC: https://www.usitc.gov/external_relations/documents/wl1_081417.pdf